us exit tax percentage

Macron was well-received by a joint session of the US. The United States is unique however in tying its exit tax to a change in visa or citizenship status.

A Uk Company Is A Good Solution For Digital Nomads Tax Consulting Uk Companies Corporate Tax Rate

Citizenship or green card.

. Green Card Exit Tax 8 Years Tax Implications at Surrender. The exit tax is essentially the application of US income tax on the portion of that phantom gain that exceeds US690000 as of 2015 as. In the United States the expatriation tax provisions under Section 877 and Section 877A of the Internal.

The term expatriate means 1 any US. An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a country. The Foreign Earned Income Exclusion threshold for 2018 was 103900.

The decision to become a US tax resident or to leave the US tax system is not one that should be taken lightly. This article is about tax applied to individuals who move out of a country. As the percentage of this amount that you must pay as part of your exit tax is based on your marginal tax rates it is likely to be different for everyone currently it cannot be any higher than 238.

The expatriation tax consists of two components. Exit Tax Expatriation Planning. The United States has a unified gift and estate tax system that applies to gifts made during life and bequests made at death.

Exit Tax and Expatriation involve certain key issues. For 2021 the highest estate and gift tax rate is 40 percent. These simplified single-issue examples are only for clarity.

An expatriation tax is a tax on someone who renounces their citizenship. If you have any difficulty with this it is a good idea to contact a tax accountant as they can estimate the amount that you would have to pay. In a few cases the tax will be imposed by 30 withholdings on payments to you forever and ever.

It was the 58th anniversary of French President Charles de Gaulles address to a joint session on April 25 1960 an event I was privileged to witness in. For other kinds of exit tax see Exit tax. For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000.

The exit tax and the inheritance tax. The tax authorities treat this final tax return much like they would treat the tax return of a deceased person says Poitras. Finally here is Ms answer.

Eligible deferred compensation items. If the rate is 25 per cent but no tax is paid in the new country of residence there is no double tax. It rises to 105900 for 2019 and 107600 for 2020.

Other countries have exit taxes too. 6 NovemberDecember 2020 Pg 60 Gary Forster and J. If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you expatriate is US1200 per ounce then you have no unrealized gain and wont owe any Exit Tax.

This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to. Anytime a US citizen or long-term permanent resident chooses to leave the US taxation system they must be aware of the tax consequences of doing so especially in light of the US exit tax that was brought into effect in 2008 under the HEART Act.

It rises to 12200 for 2019 and 12400 for 2020. The Child Tax Credit remains 2000 for all three years with the refundable part that many expat parents can claim as a payment also staying the same at 1400 per child. The Basics of Expatriation Tax Planning.

In most cases it will be in one giant lump in the year that you give up your US. 877Ag2A long-term resident is an individual who is a lawful permanent resident ie a green card holder of the United States. Since it will include your departure date the change will be confirmed when you file a final tax return by April 30 of the year following the one you left Canada.

This often takes the form of a capital gains tax against unrealised gain attributable to the period in which. One system of estate and gift taxation applies to US citizens and. Once you have paid the exit tax either in a giant lump sum.

Its the last chance for the CRA to tax the. Citizen who relinquishes his or her citizenship and 2 any long-term resident of the United States who ceases to be a lawful permanent resident of the United States Sec. This is called citizenship-based taxation.

Through the FEIE US expats can exclude up to 107600 of their 2020 earnings from US income tax. In direct answer to Ms question you will pay tax once and once only when you exit the United States. Youre going to get taxed by the IRS on that US1 million gain.

World wide US expatriate tax preparation serving expert US residents expatriates individuals and business for 23 years in over 20 countries and more than 15 states. The mark-to-market tax does not apply to the following. It is the IRSs last chance to tax you.

Relinquishing a Green Card. If the IRS can rely on tax withholding rules to assure full collection of income tax the covered expatriate pays tax at a 30 rate on US. Congress on April 25.

An exit tax on the deemed sale of all your assets. 13000 in 2011 and then subject to the highest marginal estate tax rate in existence in that. Citizenship or long-term residency by non-citizens may trigger US.

Unrealized gains are valued on departure day and taxed at the new lower 30 flat tax rate Macron has promoted. IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US. Ineligible deferred compensation items.

Expatriation from the United States. Your average net income tax liability from the past five years is over a set amount 171000 for 2020 You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years.

Samvat 2075 Was A Year Of Diis Sip Flows Helped Cushion Fii Outflow Hit Investing Books Dividend Investing Systematic Investment Plan

What Are The Us Exit Tax Requirements New 2022

Renounce U S Here S How Irs Computes Exit Tax

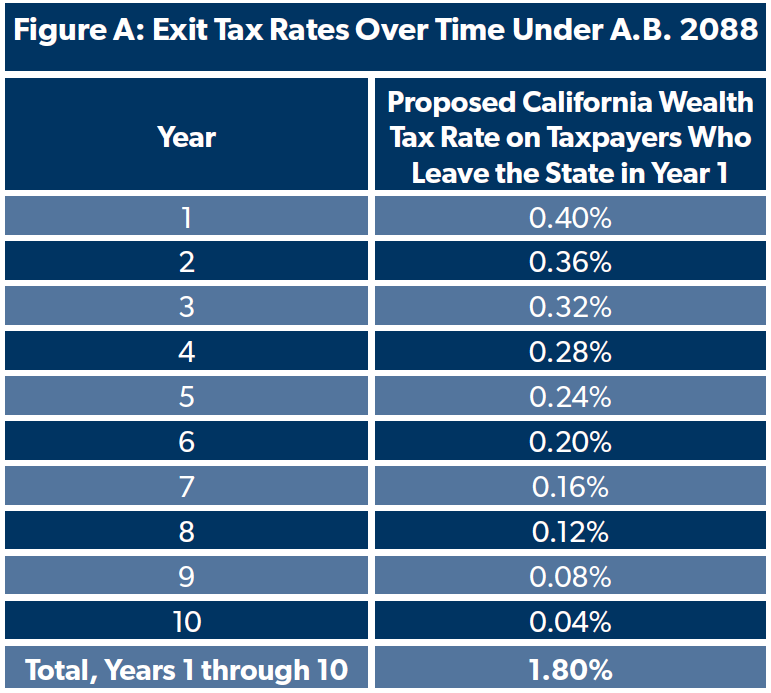

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Solved Project Shopping Cart Program Logicprohub Solving Python Programming Programming Tutorial

Renouncing Us Citizenship Expat Tax Professionals

Exit Tax Us After Renouncing Citizenship Americans Overseas

Income Tax Return Filing Tax Slabs Exemption Limits Other Rules Income Tax Return Income Tax Tax Return

Green Card Exit Tax Abandonment After 8 Years

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax In The Us Everything You Need To Know If You Re Moving

Investing Archives Napkin Finance Investing Personal Finance Budget Finance Investing